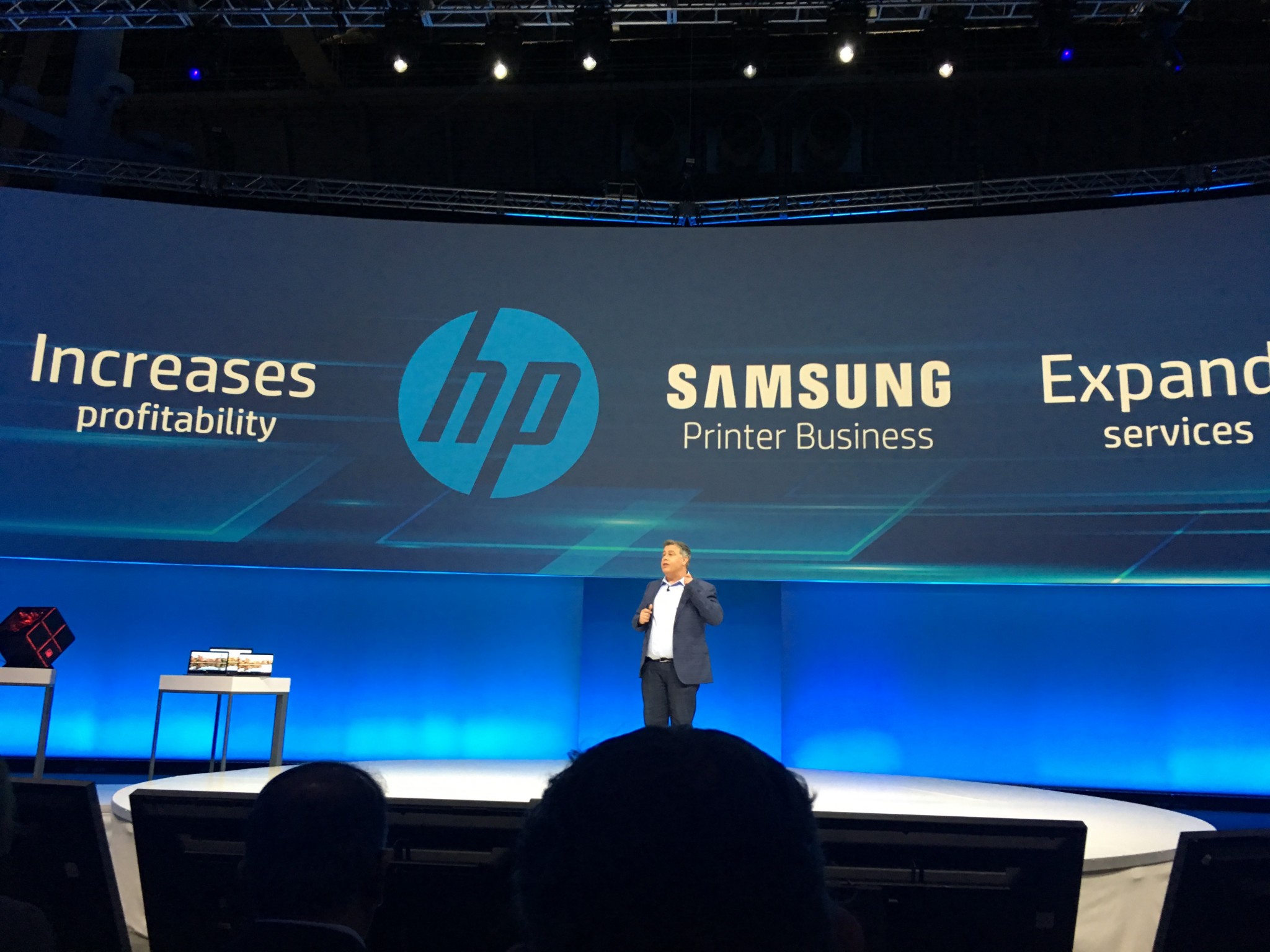

By Andy Slawetsky – I recently attended the HP Global Partners Conference in Boston. I knew ahead of time I was going there to see HP announce their biggest, most important print launch ever – the announcement of an A3 copier/MFP line. When I woke up Monday to get my article ready to post, I noticed another announcement in my in-box. HP acquired Samsung’s print division.

No doubt we’re reinventing says Dion. Change = opportunity. This is a story of reinvention. #gpc2016 #hp pic.twitter.com/yZgmM4ga1F

— Industry Analysts (@aslawetsky) September 12, 2016

The Global Partners Conference is an annual event where HP brings analysts and press (about 1,300 this year) to a central location where they spend several days talking about What’s Happenin’ with HP. This year’s conference – the first since their split, still included both HP companies HP Enterprise (HPE) and HP, Inc. (HP)

This is like the nicest divorce ever. Everyone was still under one roof, sharing customers and pretty much getting along like nothing ever happened. If you didn’t know they had split, you certainly wouldn’t have known it from being at this event. Where competitors’ splits have created distinctly separate companies, HPE and HP seem as entrenched as ever, which is a good thing I guess – minimal impact on the customer.

Enrique shows the new #hp product line biggest printer launch in their history #gpc2016 pic.twitter.com/9Lph1BDMr5

— Industry Analysts (@aslawetsky) September 12, 2016

Back to the real news and what I was there to see. An A3 copier MFP line. Finally.

Oh, and by the way, there was the Samsung news too.

HP owns 40% of the A4 printer market. They used to own about 70% back in the day. That slip isn’t as bad as it seems as 20 years ago there were a lot less printers out there and far fewer competitors. I would bet that at 40% market share, HP has more printers in the field today than when they did when they had 70% market share.

HP has dabbled with A3 before with limited success. But not like this. In the past they have relabeled MFPs from Konica Minolta. They also created the first office-level inkjet MFP, the dubious Edgeline product that people still talk about.

Side note: I liked Edgeline. I think I was the only one. I wish they had kept the program going, I am sure they would have improved that product, which was actually pretty good in my tests under most conditions. The technology that was in Edgeline set the early stages of their PageWide printing, which is now used in products ranging from ultra fast inexpensive desktop printers to the biggest of web-press printers and their forthcoming A3 PageWide MFPs.

HP also relabels A3 products from Sharp at this very moment. These devices are sold in MPS engagements and from what I hear, they sell very few of them. Understandably, if I was at HP selling MPS, I’d much rather stick with my cohesive product line than involve devices that don’t fit with my A4. Common UI’s, consistency with workflow and software are all advantages with keeping things in house.

Click here to see all pictures and video

The current A3 strategy is a relationship to provide these products when they absolutely need them. HP never intended to roll this out to other distribution channels.

The future A3 strategy is very different. This isn’t dabbling. This isn’t HP filling a gap in their portfolio. This is HP taking square aim at the $55 billion dollar copier market and saying, we’re all in. And for just over one billion dollars, they certainly are all in. Go big or go home, right?

What does it mean for Canon?

Canon has been the world’s biggest printer engine manufacturer for years. That’s partially because HP and Canon have worked together for 30 years and Canon makes nearly all of the LaserJet print engines and has since day one.

Canon’s chairman and CEO Fujio Mitarai commented, “HP and Canon have long discussed print innovation to create customer value in business printing and in the growing MPS market. This transaction will further evolve our collaboration and bring about growth for both of our companies.”

Mr. Mitarai runs one of the industry’s premier brands and knows far more than I do about their situation but from where I sit, this seems like horrible news for Canon’s printer and aftermarket factories.

Click here to see all pictures and video

I can’t imagine it will be long before HP turns to their own newly acquired Samsung factories and shifts their portfolio to an entirely internally developed printer line.

Focusing on the Copier Dealer Channel. Again.

HP has been down this road again and again. It makes me think of Charlie Brown and the football. Kick it Charlie Brown, I won’t pull the ball away this time, I swear.

I think that’s in the past. HP just spent over $1B in acquiring Samsung and millions beyond that developing their PageWide A3 products. These aren’t sold over the Internet. They’re sold through B2B channels and the BTA channel is the only game in town. HP is going after this channel. They now need copier dealers more than ever.

Can they succeed?

The BTA channel is incredibly loyal. Dealers don’t hop from brand to brand. They have long-standing relationships, often going back 20-30 years with their primary brand, and maybe longer. Unhooking dealers from their primary brands is next to impossible.

This is where Samsung struggled. I like their products and their 60-PPM mono A3 is the most reliable MFP I have ever tested; great touch screens, very cool technology. But their goals were way too high in my opinion. Samsung wanted to be a top 3 brand in 5 years. Ask Sharp and Kyocera and Toshiba and other established companies how easy it is to jump behemoths like Ricoh, Canon, Konica Minolta and Xerox.

It wasn’t for lack of trying, they were super aggressive and signed up a lot of dealers, but those dealers brought them on as a second or third brand. But if their measure of success is being the primary brand with the dealers they sign, then they failed.

Personally, I think they did a great job of establishing a strong disruptive presence in the market. Given more time and budgets equal to what their competitors work with, I think they could have made some serious noise.

HP has a different approach. They aren’t trying to be a dealer’s number one. They just want to get in the pitchbook. I spoke with VP and head of Indirect MPS Programs and Services David Laing quite a bit about this. They realize they need to establish relationships in this channel and that they have a lot of work to do.

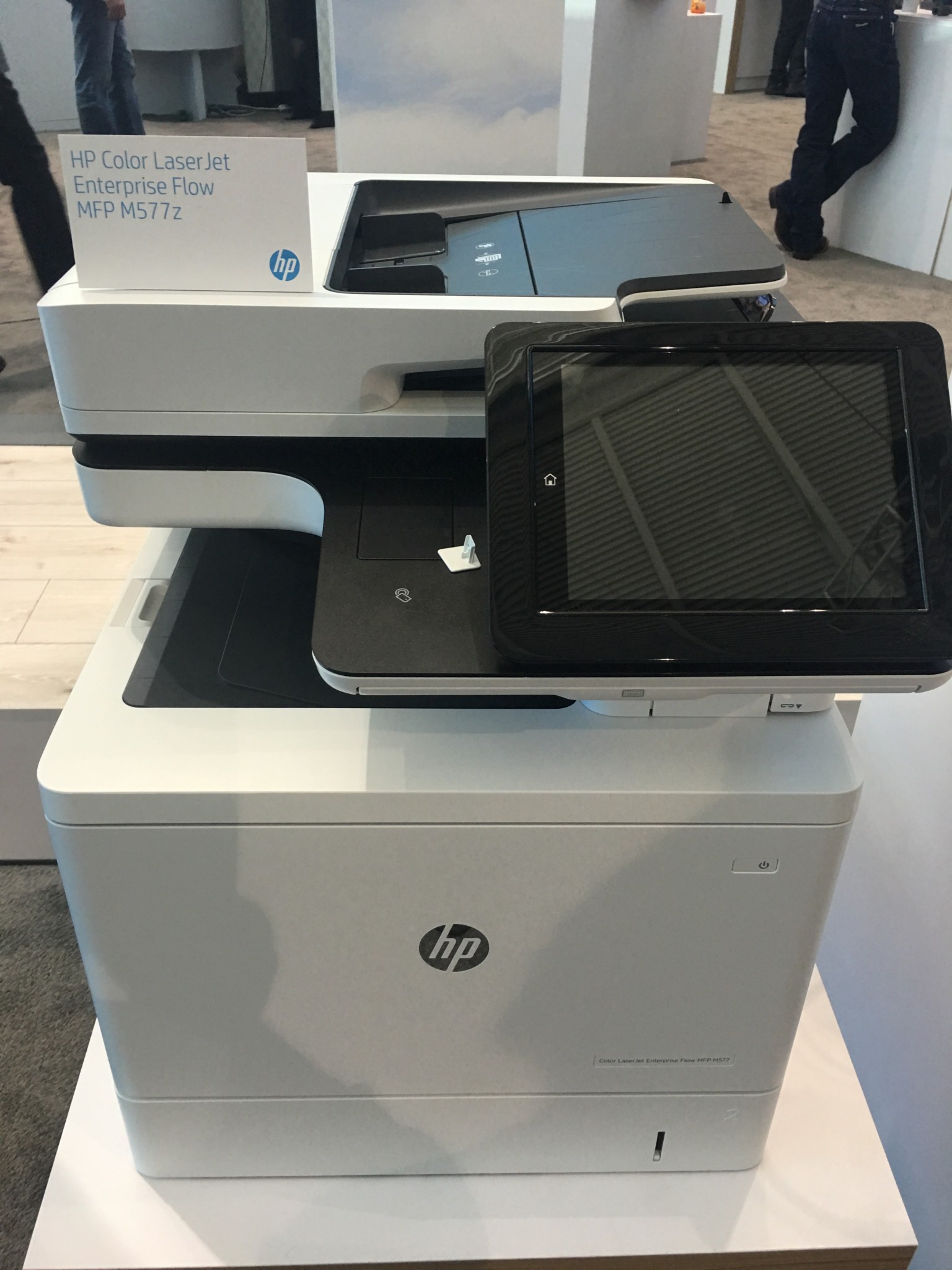

David talked to me about how this is the first time they’ve ever had a full product line to offer dealers and in the past, that was a major disadvantage. Now it’s not an issue. They will have laser MFPs that print up to 60-PPM in color and mono as well as inkjet PageWide products that can print up to 80-PPM.

Will dealers want to talk to HP after so many past disappointments? You bet you’re a$$. I ran into Steve Gau from Marco and saw Junior and Senior Doyles (Dex) at the product area where Sr. was pulling out paper trays and schooling Jr. on how few replaceable parts there are in this 80-PPM A3 inkjet. I’m told HP had tons of major imaging dealers there including POA, RJ Young, Centric, Loffler and others.

It occurred to me while watching the Dex crew evaluate the PageWide product that they didn’t really look at the laser A3 from Samsung. Maybe they’re already familiar with it, but I couldn’t help but think did HP really need to acquire Samsung’s printer operation?

To be clear, they get a lot out of this deal; 6,500 patents, 1,300 researchers and engineers, PrinterOn (the Canadian mobile print company Samsung bought in 2014) and a young but developing existing list of current BTA dealers. They’ll get factories and even some key executives we met when we visited Samsung earlier this year who will be transitioning over to HP. They could also potentially take ownership of the production of their own printer engines and aftermarket, cutting their reliance on a partner who is also a competitor with arguably the largest market share for A3 products.

This was a huge and incredibly risky move for HP. They have a ton of work to do in pulling all of this together but like I said before, they’re all in. They realize they need BTA dealers now in a way they didn’t in the past.

One of the biggest issues that always prevented HP from truly succeeding in this channel was that they didn’t care where the customer bought the device, as long as they bought it. B2B companies do not want to sell against retail and websites. It devalues their services and what they do.

But these products are different. These will be dealer products and customers won’t be able to simply go online (I think) and buy supplies. These products will be sold just like everyone else’s A3 devices.

HP is coming into this touting their advanced technology, especially with respect to security. I have to say there was a line in their press release that bugged me when talking about this $55B channel. “Copiers are outdated, complicated machines…”

Last I saw, Marco is a $275M dealer. I don’t think they did it selling outdated, complicated machines. Rather than coming in with this attitude, I think another approach touting the strength of the HP brand, technology and forthcoming programs might be more effective.

HP has a ton to offer dealers and if they can create a program and most importantly, stick with it, they could take a nice bite out of that $55B copier industry number.

It will be interesting to watch this all unfold over the next 12-18 months and I wonder what they’ll do with the dealer program that Samsung has built over the last five years. This could be a nice hidden asset of this deal. Stay tuned, you know I’ll be covering it as it unfolds!

~Andy