By Andy Slawetsky, Industry Analysts Inc. – Xerox released their third quarter numbers this morning and here are some key takeaways.

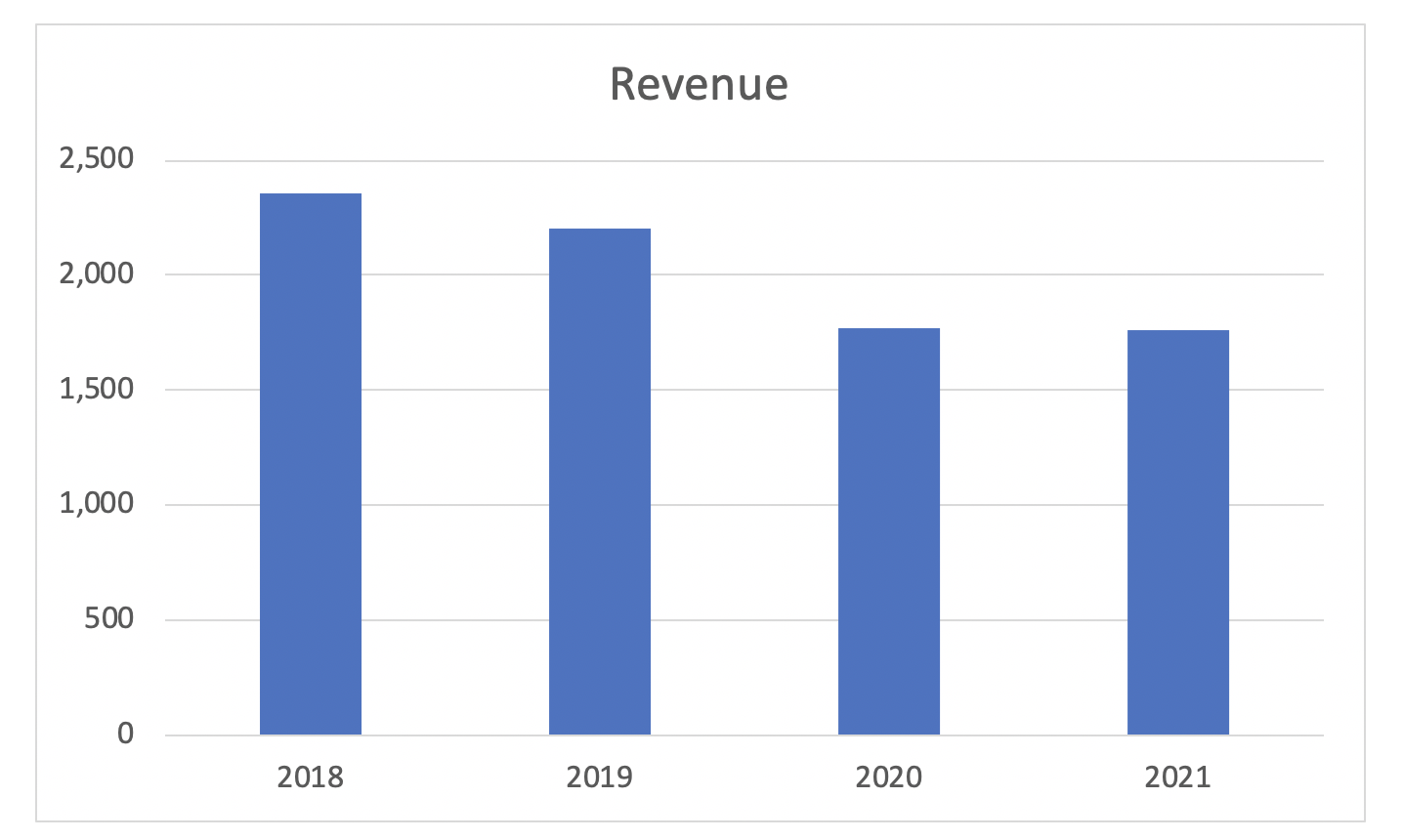

- Revenue was down YoY

- Sales Revenue was up

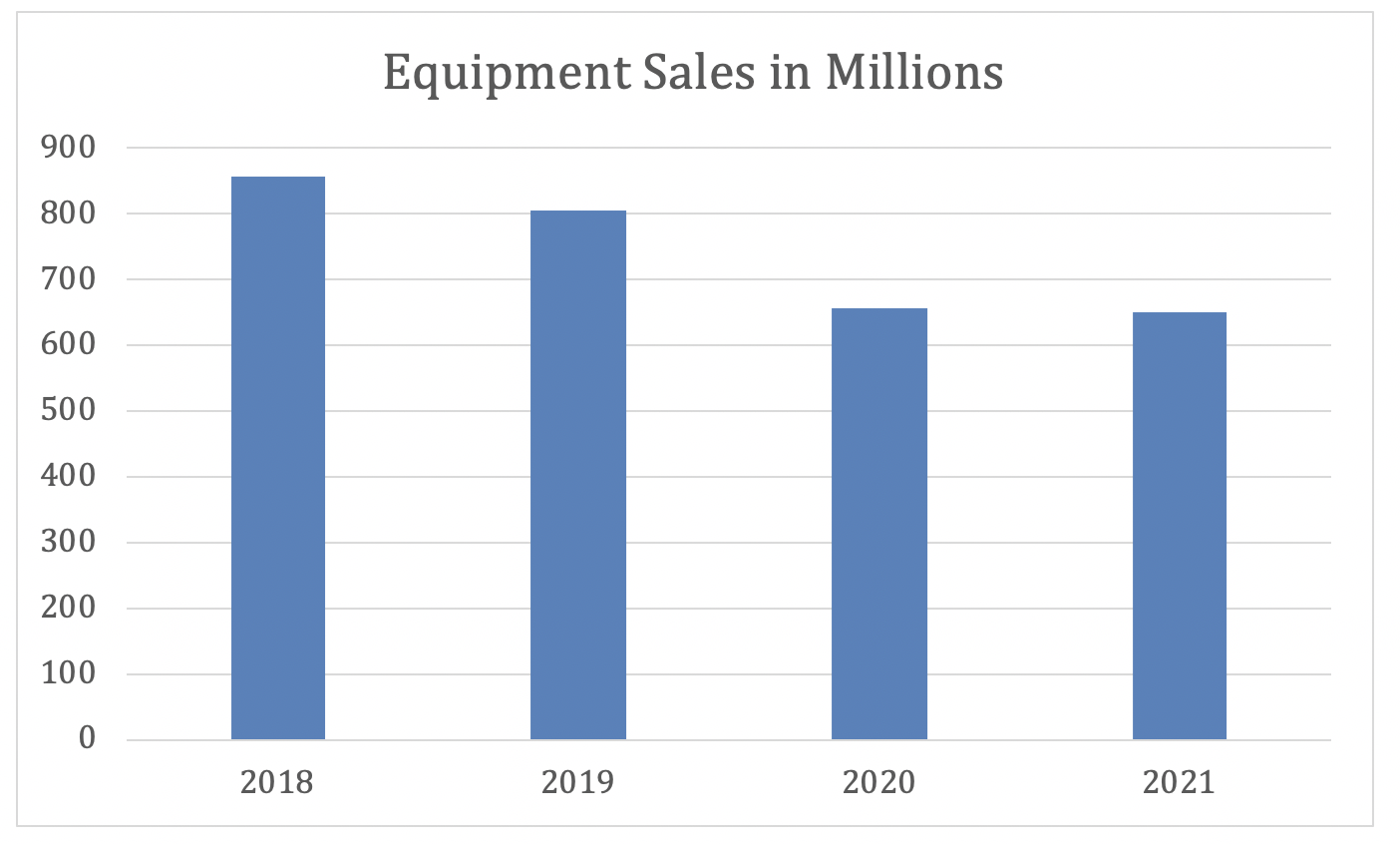

- Equipment Sales down 7.6%

- Post Sales Revenue up 1.6%

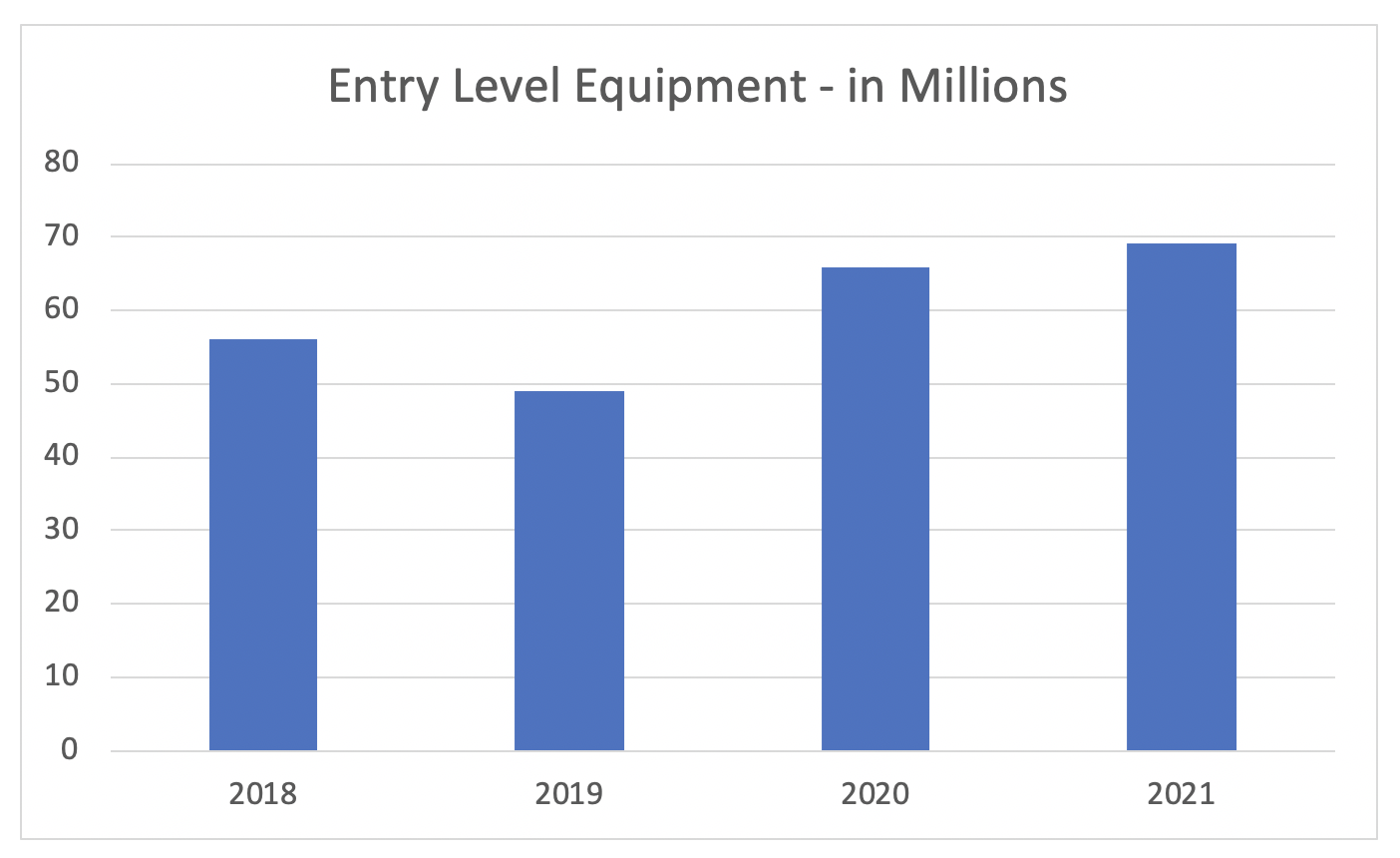

- Entry Level Equipment up 4.5%

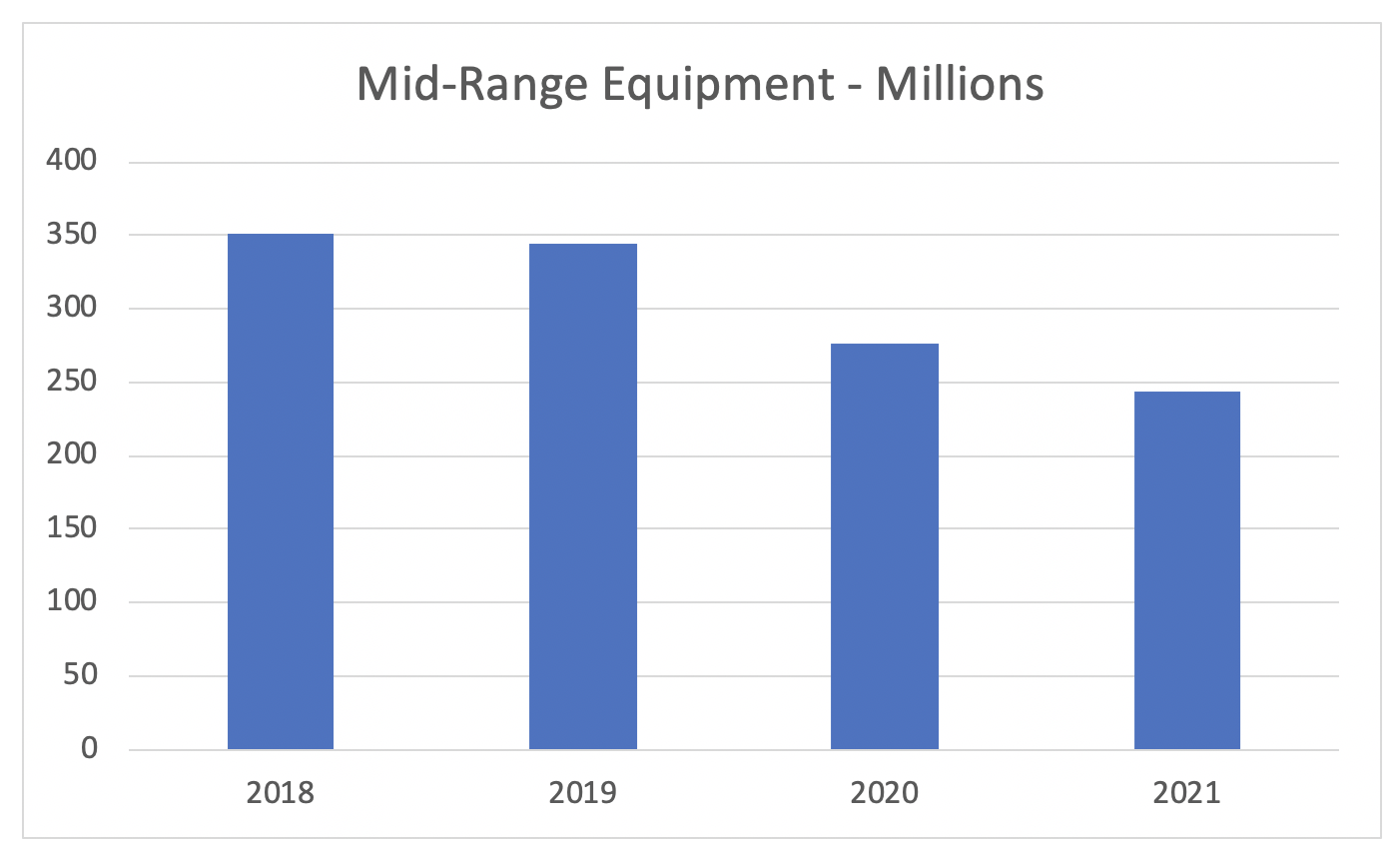

- Mid-Range Equipment down 11.6%

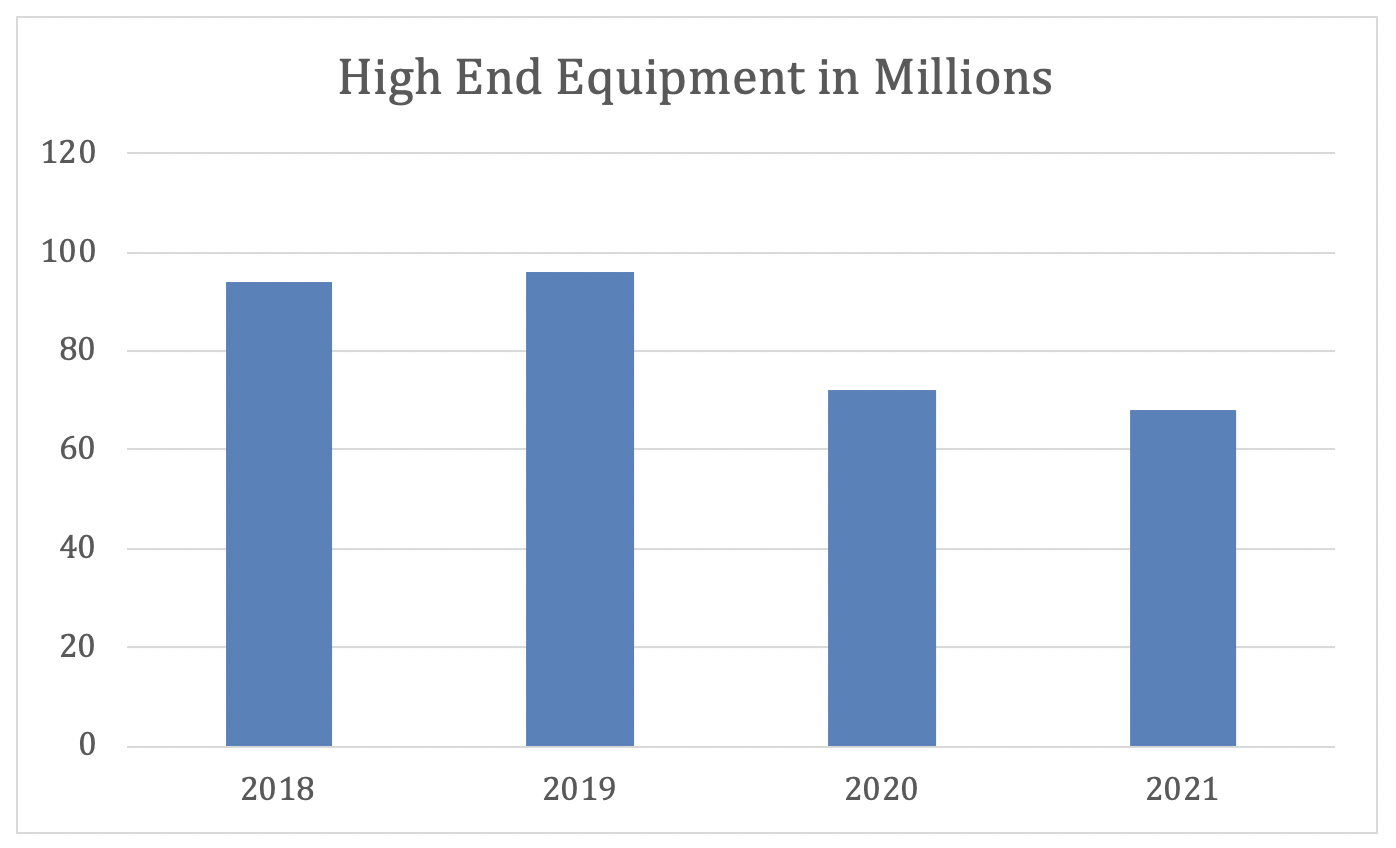

- High-End Equipment down 5.6%

Xerox cites the Pandemic as the chief cause of the struggles they’re facing. The following statement can be found in their earnings release.

During the third quarter 2021, our business continued to be impacted by the COVID-19 pandemic. The prolonged and extensive impact of the Delta variant drove many of our customers to delay their plans to return employees to offices. As a result, while we continued to see a correlation between the roll-out of vaccinations, the return of employees to the office, and the gradual recovery of our post sale revenues, the marginal improvement in our page volume-driven post sale revenues was less than previously anticipated. In addition, global supply chain issues, created in part by the COVID-19 pandemic, have resulted in an unprecedented level of disruption that has led to shortages and transportation delays of our products and third-party IT hardware.

While there were pockets of success, such as with entry level hardware (up 4.5%), the continued erosion of their mid-range and high-end equipment will continue to impact their revenue. In fact, Xerox is down considerably from where they were in 2018 (and they were already in the midst of a multi year slide).

(All Data in these charts are from today’s Xerox release and previous Xerox releases)

Equipment Sales Down 24% since 2018 (Down $205 Million)

Revenue Down 25% Since 2018 (Down $594 Million)

Entry Level Equipment Up 23%; Up $13 Million Since 2018

Mid-Range Equipment Down 30% Since 2018 (Down $107 Million)

High End Equipment Down 28% Since 2018 (Down $26 Million).

Here is a link where you can see Xerox’s entire Q3 press release

While the $13 million improvement in A4 over the last 4 years is commendable, Xerox would have needed to sell 10X that amount to offset the losses in mid and high volume equipment during that period. They simply cannot outrun the A3 and production equipment losses with their current A4 sales levels.

With the current supply chain issues, the pandemic and challenging selling conditions Xerox discussed in their earnings release, it will be interesting to watch what Xerox does to try to change their trajectory in 2022.

SOURCE Industry Analysts Inc.

Help Customers Become More Efficient and Profitable with the Latest in Workflow Automation