Xerox third quarter earnings are out today and while revenue continues to slide, there were pockets of good news. Here is some of the good and bad from today’s earnings announcement:

The Good

- Equipment sales revenue up

- A4 sales up Q3 YoY

- A3 sales up Q3 YoY

The Bad

- $429 product backlog

- Total revenue down YoY

- Total profit down YoY

- Financing down YoY

- Production sales down Q3 YoY

Xerox XBS branches and resellers are still struggling with the massive product backlog. While the backlog is 2.5% lower than last quarter, competitors are recovering at a faster pace. Anyone who has sold office equipment knows how vulnerable an account is when they’re waiting for installations.

When looking at Xerox’s historical date, we relied on zippia.com for the following two charts.

Xerox Annual Revenue Over Time

Xerox Annual Growth Rate Over Time

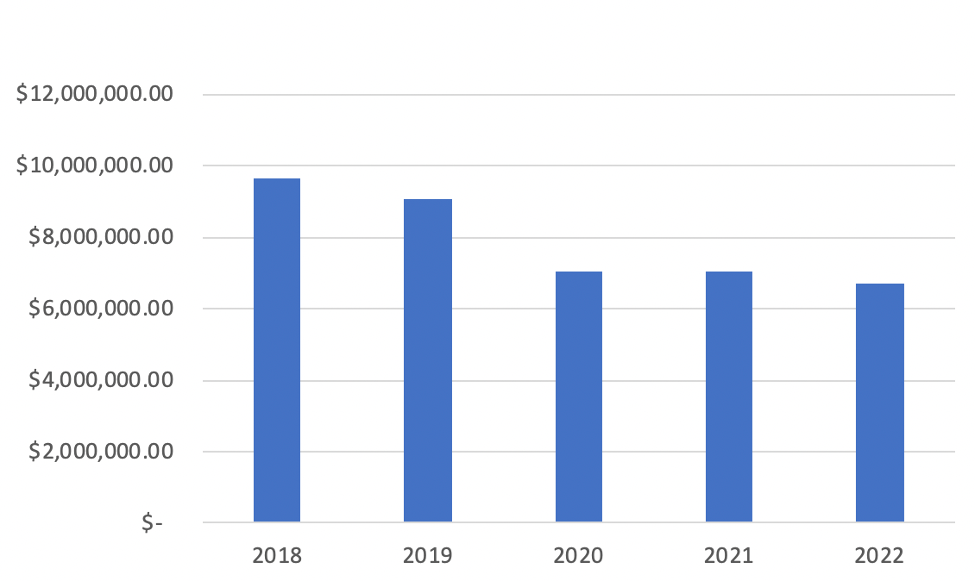

Xerox Annual Revenue 2018 – 2022

Xerox Annual Revenue 2018 – 2022

If the rate of loss Xerox has experienced over the last several years continues, they will be under $2 billion by 2027 – a mere five years from now.

Turnarounds need to start somewhere, perhaps this improvement in A3 and A4 sales particularly will be the spark. The demand from customers is there, but can Xerox fill the orders? Time will tell.

SOURCE Industry Analysts Inc.