The following appears on asia.nikei.com

The following appears on asia.nikei.com

FRAMINGHAM, Mass., February 21, 2018 – The worldwide hardcopy peripherals (HCP) market increased 1.2% year over year to nearly 28.1 million units in the fourth quarter of 2017 (4Q17), according to the International Data Corporation (IDC) Worldwide Quarterly Hardcopy Peripherals Tracker. The growth was driven by a solid performance in the inkjet market, which grew 3.3% year over year. Shipment value, on the other hand, decreased 1.0% year over year to $13.7 billion in the quarter.

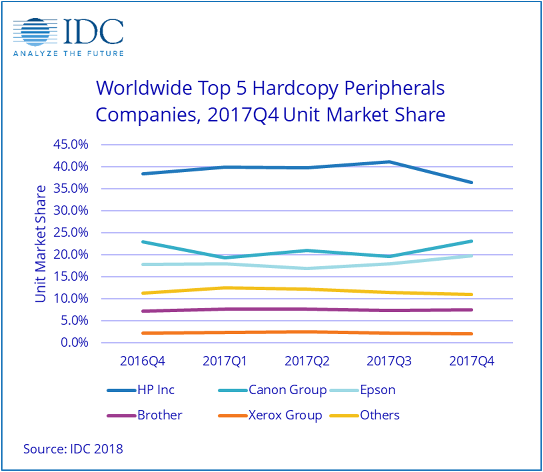

Three out of the top 5 companies saw year-over-year shipment growth in 4Q17, with Epson leading the way at 12.2%, followed by Brother at 5.2% and Canon Group’s 1.4%. Top-ranked HP Inc. recorded a year-over-year decline of 3.8% in 4Q17.

For the full year 2017, HP Inc.’s shipments of more than 39 million units remained unchanged from 2016 while Epson, Brother, and Canon Group posted positive year-over-year growth of 4.6%, 3.6%, and 1.3%, respectively.

Notable highlights from this quarter include:

- Contributing to inkjet’s growth of 3.3% year over year in 4Q17 were increases from Latin America, Central & Eastern Europe, Middle East & Africa, and Asia/Pacific (excluding Japan) (APeJ). Some of the factors behind these gains included a rise in shipments of ink tank devices outside of the APeJ region, increased salary levels that had helped to boost consumption along with the rapid growth of e-tail channels in China, and high demand from businesses after the implementation of GST in India.

- Asia/Pacific (excluding Japan) outperformed all other regions in the laser segment, posting 6.1% year over year growth to 3.9 million units shipped in 4Q17. China continued to be the main source of growth in the region due to strong expansion of the small and medium-size business segment and strong demand during the year-end online shopping festivals. India was also a major contribution to growth in the region with a 19.0% year -over-year increase in shipments.

- Epson showed positive year-over-year growth in all IDC’s regional markets. Epson launched more new models this quarter to help support its push of ink-tank devices. Although the L360 is still Epson’s top model, adoption of the L380 also showed strong momentum as the shipment volume almost surpassed the L360 model this quarter. Meanwhile, the L1300 had been the best performing model of Epson’s new range of devices.

| Worldwide Hardcopy Peripherals Market, Unit Shipments, Company Share, and Year-Over-Year Growth, Q4 2017 (based on unit shipments) | |||||

| Companies | 4Q17 Unit Shipments | 4Q17 Market Share | 4Q16 Unit Shipments | 4Q16 Market Share | 4Q17/4Q16 Growth |

| 1. HP Inc | 10,258,659 | 36.5% | 10,666,405 | 38.4% | -3.8% |

| 2. Canon Group | 6,483,914 | 23.1% | 6,395,229 | 23.0% | 1.4% |

| 3. Epson | 5,550,928 | 19.8% | 4,946,602 | 17.8% | 12.2% |

| 4. Brother | 2,114,832 | 7.5% | 2,010,964 | 7.2% | 5.2% |

| 5. Xerox Group | 580,153 | 2.1% | 608,240 | 2.2% | -4.6% |

| Others | 3,097,483 | 11.0% | 3,137,508 | 11.3% | -1.3% |

| Total | 28,085,969 | 100.0% | 27,764,948 | 100.0% | 1.2% |

| Source: IDC Worldwide Quarterly Hardcopy Peripherals Tracker, February 2018 | |||||

| Worldwide Hardcopy Peripherals Market, Unit Shipments, Company Share, and Year-Over-Year Growth, 2017 (based on unit shipments) | |||||

| Companies | 2017 Unit Shipments | 2017 Market Share | 2016 Unit Shipments | 2016 Market Share | 2017/2016 Growth |

| 1. HP Inc | 39,228,206 | 39.2% | 39,213,263 | 39.6% | +0.0% |

| 2. Canon Group | 20,859,964 | 20.9% | 20,599,235 | 20.8% | +1.3% |

| 3. Epson | 18,262,649 | 18.3% | 17,463,131 | 17.6% | +4.6% |

| 4. Brother | 7,521,495 | 7.5% | 7,261,285 | 7.3% | +3.6% |

| 5. Xerox Group | 2,302,668 | 2.3% | 2,468,446 | 2.5% | -6.7% |

| Others | 11,775,411 | 11.8% | 12,035,500 | 12.2% | -2.2% |

| Total | 99,950,393 | 100.0% | 99,040,860 | 100.0% | +0.9% |

| Source: IDC Worldwide Quarterly Hardcopy Peripherals Tracker, February 2018 | |||||

Notes:

- IDC tracks A2-A4 devices in the Worldwide Quarterly Hardcopy Peripherals Tracker.

- Hardcopy Peripherals include single-function printers, multifunctional systems (MFPs), and single-function digital copiers (SF DC). Data for all vendors are reported for calendar periods.

For more information about IDC’s Worldwide Quarterly Hardcopy Peripherals Tracker, please contact Phuong Hang (phang@idc.com).

About IDC Trackers

IDC Tracker products provide accurate and timely market size, vendor share, and forecasts for hundreds of technology markets from more than 100 countries around the globe. Using proprietary tools and research processes, IDC’s Trackers are updated on a semiannual, quarterly, and monthly basis. Tracker results are delivered to clients in user-friendly excel deliverables and on-line query tools.

About IDC

International Data Corporation (IDC) is the premier global provider of market intelligence, advisory services, and events for the information technology, telecommunications, and consumer technology markets. With more than 1,100 analysts worldwide, IDC offers global, regional, and local expertise on technology and industry opportunities and trends in over 110 countries. IDC’s analysis and insight helps IT professionals, business executives, and the investment community to make fact-based technology decisions and to achieve their key business objectives. Founded in 1964, IDC is a wholly-owned subsidiary of IDG, the world’s leading technology media, data, and marketing services company. To learn more about IDC, please visit www.idc.com. Follow IDC on Twitter at @IDC.

All product and company names may be trademarks or registered trademarks of their respective holders.

Coverage

Companies Covered

HP Inc., Canon Inc., Xerox Corporation, Seiko Epson Corp., Brother Industries, Ltd.

Regions Covered

Worldwide

Topics Covered

Multifunction peripherals, Printers